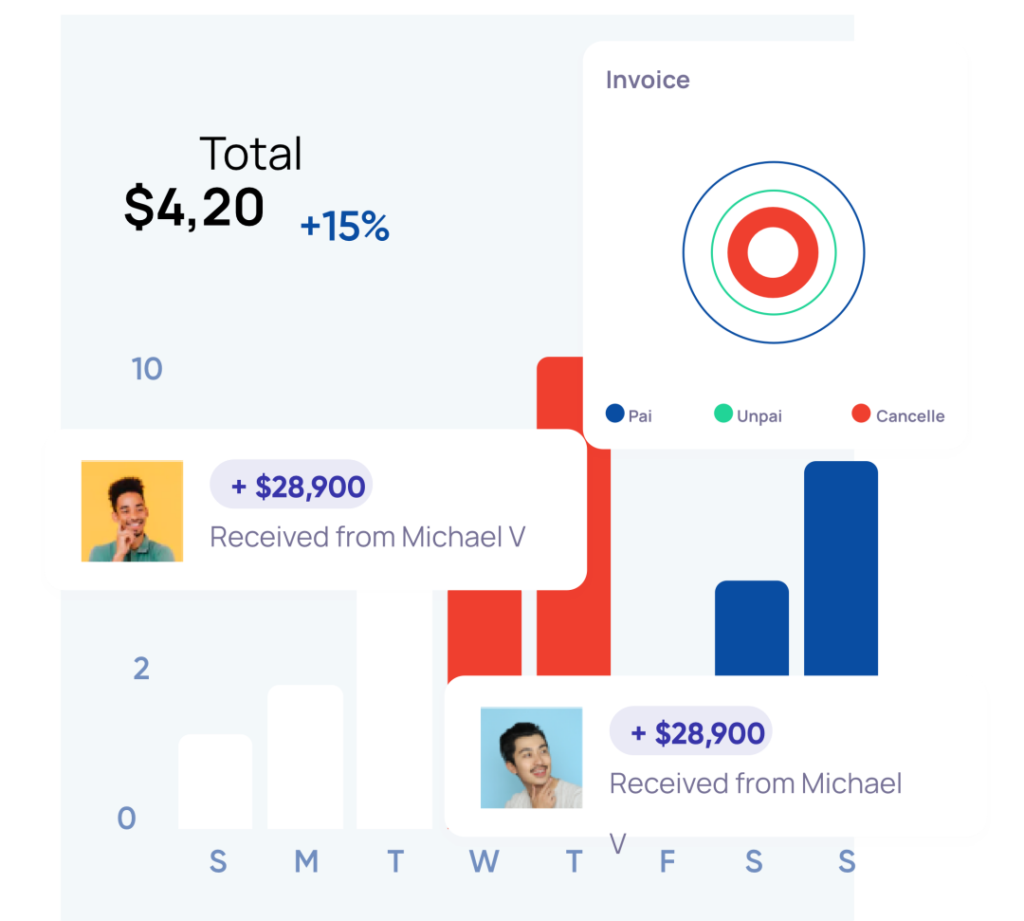

Managing payments has never been easier

Our Realtime End-2-end API integration allows for international transactions to be fulfilled in local currencies

ABOUT OPEN PESA

Receive payments quickly from anywhere

Openpesa is a B2C open banking API product, that will enable merchants take payments directly from their customers bank accounts via their mobile banking app without the need for the customer to input their credit card details in the merchants websites.

Faster and secured payments across border or checkout from your favourite shop directly from your bank account, No bank card no problems

This has hindered most foreign business from accessing the Nigerian customers as well as stopped Nigerians engaging seamlessly in international transactions –especially c2b. We aim to offer solutions to the above

WHY OPEN PESA

Why Choose Us

Pain points or problem statement

•It is difficult for customers in Nigeria and other frontier markets to buy goods from EU or US merchants

•Too many chargebacks

•Over $30Bn is lost annually due to credit card fraud

•There limits to amount Nigerian can spend with their cards ($100) on overseas merchants websites

Zara, h & m, asos, Aliexpress, amazon, prettylittlething etc, are trying to service customers based in some Nigeria’s mega cities eg Abuja, Lagos, Port-Harcourt etc, but they can not due to the regulatory policies of customers not being able to use their credit card details online to make purchases from overseas above $100.

Our Solutions

•Real time customer authentication and

•Real time verification

•Lower processing fees

•Real time transaction settlements

•Improved customer experience

Our Solutions

•Customer fully in charge of their data

•Remittance

•Cross border payment solutions

•Data mining

•Logistics

WHY OPEN PESA

Product API Features

Verification

API will verify and authenticate user via connecting with bank partners.

Access

Access the API of partner banks and access customer data.

Deposits

API will take and deposit payments from and to partner banks customers

Remittance

API will remit funds directly from the API to a designated customer bank?

Settlement

Settle customers automatically and provide seamless settlement time.

Convertion

RealTime currency conversion rates

HOW IT WORKS

All payments are linked to your Open Pesa account

Openpesa will empower businesses from all over the world to accelerate their product oerings in frontier markets by providing a secured API that would enable merchants to verify and take payments directly from their customers bank account.

How it works

STEP 1

We integrate our API into our banking partners API and also into merchant’s API, a customer checks out in the merchants website or platform and then they’d see OpenPesa payment gateway as one of the payment methods, the customer selects the OpenPesa and then the customer will be redirected to the next page that has lists of our banking partners, the customer selects their bank from the drop down menu and then logs into their bank account to verify their identity and then authorise the payment of the xyz amount in the favour of the merchant.

STEP 2

Merchants will need to register their interest in the product by providing these info

- Company Name

- Company Website

- Company Partnership Contact

- Phone Number

- Email Address

- Industry

- Number of Employees

STEP 3

Customers will need to register their interest in the product by providing these info

- Name

- Occupation

- Address

- Phone Number

- Email address

- Age Bracket

SECURITY LEVEL

Regulated by FCA, Regulated by CBN, Will be Fully Compliant to all AML, API Is In Compliance With The PCI-DSS 3.2.1, OpenPesa is committed to protecting the privacy and security of customer information incase of any security breaches and cyber attacks, and will implement an Information Security Management System (ISMS) that will be compliant with ISO/IEC 27001:2013, the international standard for information security, PCI-DSS 3.2.1, payment card industry data security standard, and the GDPR, General data Privacy protection

Creative

Team Members

An experienced team working together, crafting exceptional experiences, and growing stronger.

Eliza Weber

Director

Danial Chen

Manager

Dina Crossin

Consultant

Dina Crossin

Consultant

Dina Crossin

Consultant

Stay Updated

Latest Articles

Quickly browse the latest offers, read in-depth articles, and case studies to get the full story.

Add Call to Action Heading Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.